About

Aspire

Aspire

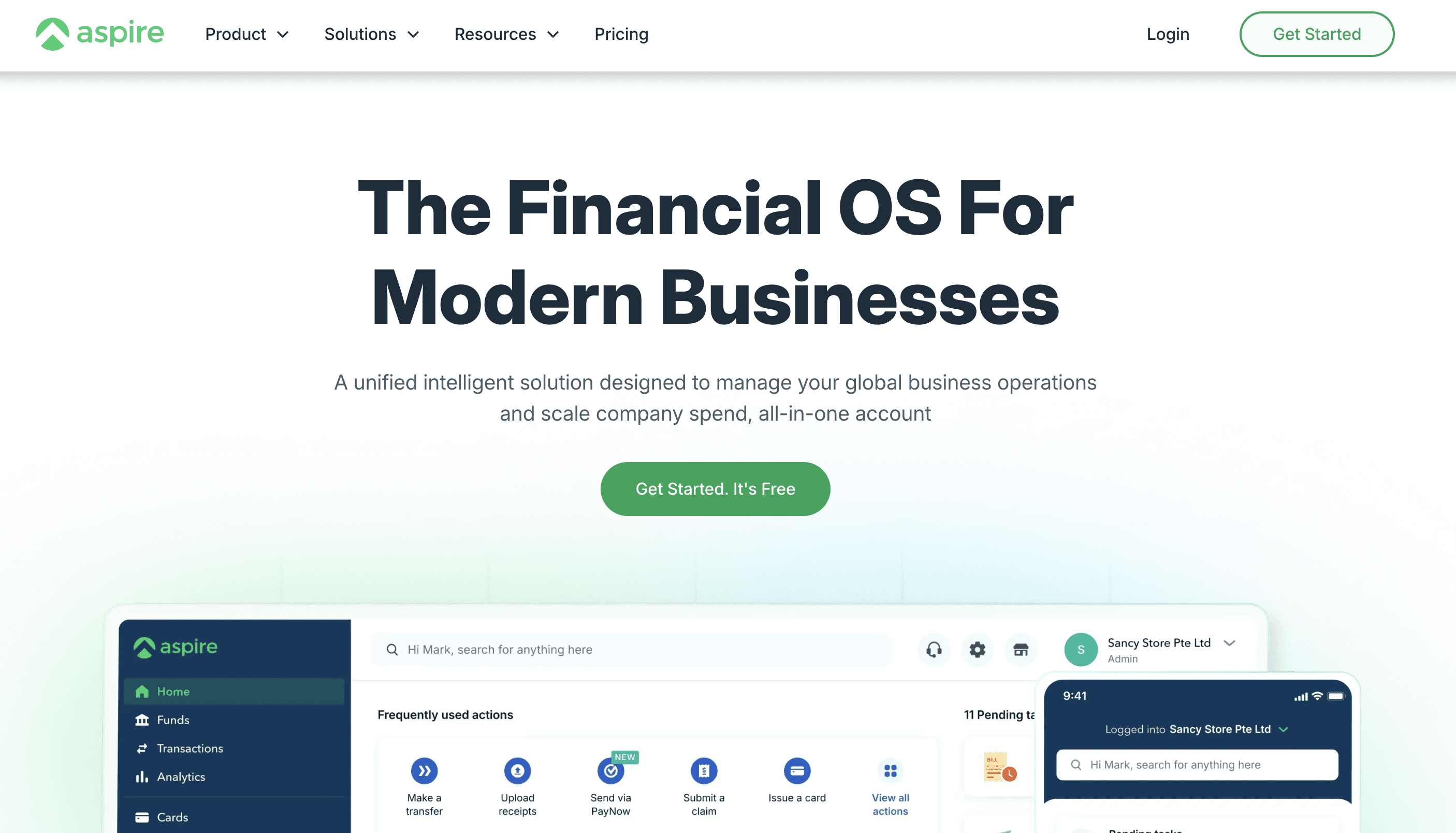

Aspire is an all-in-one finance operating system for businesses, headquartered in Singapore. Founded in 2018, Aspire helps over 50,000 businesses across 30+ markets save time and reduce costs by consolidating multi-currency business accounts, corporate cards, global payments, expense management, and yield products into a single, user-friendly platform.

Fintech

Services

Region

Website

Who Are They?

Aspire is transforming how modern businesses manage their finances by providing a unified platform that replaces fragmented banking, bookkeeping, and expense management tools. Its Aspire is transforming how modern businesses manage their finances by providing a unified platform that replaces fragmented banking, bookkeeping, and expense management tools. Its finance OS empowers startups, SMEs, and growing enterprises to streamline financial operations and focus on growth.

Financial Management

Multi-Currency Accounts: Hold, send, and receive funds in multiple currencies with competitive exchange rates, ideal for businesses with international operations.

Global Payments: Make fast, cost-effective international payments to suppliers, contractors, and partners worldwide.

Expense Control

Corporate Cards: Issue unlimited virtual and physical Visa cards with real-time spend tracking, custom limits, and instant freeze capabilities.

Expense Management: Automate receipt collection, approval workflows, and category tagging with seamless integration to accounting software like Xero and QuickBooks.

Growth & Scale

Yield Products: Earn competitive returns on idle cash balances while maintaining full liquidity.

Trusted by Thousands: Backed by Sequoia, Lightspeed, Y-Combinator, Tencent, and PayPal, Aspire achieved profitability in 2023 after closing an oversubscribed US$100M Series C round.

If you are interested in speaking with Aspire and receiving a Scalerr offer, reach out to your Scalerr contact or submit an enquiry below.